Trusted Expertise:

Our experienced team is dedicated to helping you achieve a better credit score and financial future with proven strategies.

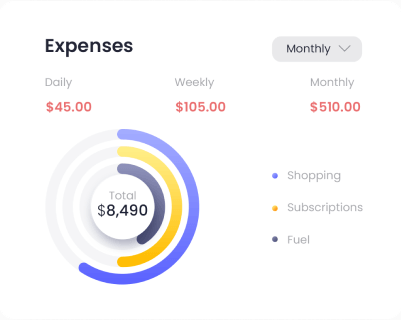

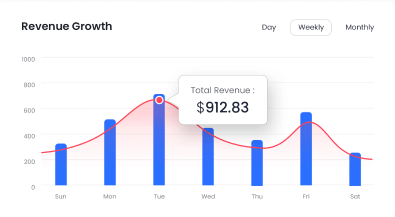

A credit score is a three-digit number, typically 300 to 900, indicating your creditworthiness. It is based on factors like payment history, credit utilization, and the length of your credit history. Lenders use this score to assess the risk of lending to you. A higher score improves your chances of securing loans with better terms.

A low credit score can lead to higher interest rates and loan rejections. It can also affect your ability to rent homes, get certain jobs, or sign up for utilities without deposits. Poor credit limits financial opportunities and increases long-term financial stress. Maintaining a good score is crucial for accessing favorable financial products.

A positive credit score improves your chances of getting loans and credit cards with better interest rates. It offers access to premium financial products, higher credit limits, and rental or job opportunities. A strong score also provides financial flexibility, helping you manage and grow wealth more effectively.

At GenZPe, we provide personalized credit improvement and debt management solutions designed to meet your unique financial needs. Our expert guidance ensures transparent, effective results, helping you confidently rebuild your financial future.

Our experienced team is dedicated to helping you achieve a better credit score and financial future with proven strategies.

We tailor our services to your unique financial situation, ensuring the best possible outcomes.

At GenZPe, we are dedicated to helping GenZs and Millennials take control of their financial futures by enhancing their credit scores and providing effective debt management solutions. Our mission is to equip young individuals with the tools and knowledge they need to rebuild their financial health and achieve long-term financial stability.

At GenZPe, we are dedicated to helping GenZs and Millennials take control of their financial futures by offering tailored solutions to enhance credit scores and manage debt responsibly. Our mission is to make financial freedom within reach for everyone by delivering clear, personalized guidance and expert support, ensuring long-term financial stability and success for our clients.

Our team at GenZPe consists of seasoned financial experts and Chartered Accountants (CAs) dedicated to your success. With years of industry experience, we offer tailored solutions to help you improve your credit score and manage debt. We are committed to delivering trusted, professional advice that empowers you to make smarter financial decisions for a secure future.

Elevate your credit score with personalized strategies designed to enhance your financial health. Build a strong foundation for future financial opportunities.

Identify and dispute inaccuracies on your credit report to ensure it reflects your true financial status. Monitor progress and maintain a clean report for long-term stability.

Receive expert guidance to analyze and manage your debts effectively. Create a sustainable plan to reduce financial stress and regain control over your finances.

A SaaS Platform: Verify individuals' PAN, Aadhaar, bank accounts, ITR, CKYC, and credit reports, along with businesses' master data, GST details, and CIC reporting for seamless compliance and comprehensive customer profiling.

Seamlessly integrate essential financial services into your platform with robust APIs designed to enhance efficiency, scalability, and innovation.

We assess your credit and debt profile to identify areas for improvement.

Receive a tailored plan designed to boost your credit score and manage debt.

Implement the plan with our expert support and monitor your progress regularly.

Reach your financial goals and maintain a healthy credit score and debt profile.

Facing creditor harassment, loan rejections, or struggling to repay your debt? Contact us now for urgent support, legal protection, and personalized strategies to regain financial control.